Online banking has made the banking experience more convenient for people in several ways. People can now send money online through things like PayPal and Venmo. Paying bills has become as easy as having your biller auto-debit the amount from your account.

Thanks to technological advancements, banking-related transactions have become less tedious and troublesome. What’s more, it’s as easy as opening a bank account and signing up. This is why many people opt to engage in various forms of online banking activities.

However, despite the simple onboarding process with online banking, keeping and maintaining that account is no easy task. This is because there are still several responsibilities and things that one must do to help keep that account running.

Simply put, people still need to do their part to manage their bank accounts. Doing so not only makes their life easy but also keeps them out of trouble.

The Importance Of Managing Your Account

This should go without saying, but it’s vital that you learn how to manage your online banking account. Much like any regular banking account, your online account is tied up with your finances–money.

If you’re not responsible about it, you could lose your money, among several other possibilities. Considering that it’s hard to earn money as it is, you should do what you can to secure every cent you have in your account.

If you have this aspect of your finances in order, you can at least be assured that every other financial factor in your life will not suffer. After all, if you take care of your money and manage it well, you’ll be able to make financial decisions with as little difficulty as possible.

What’s more, you can also help do your part to ensure your financial security.

Ways To Manage Your Account

With that in mind, how does one manage their online banking account? Fortunately, it’s a process that isn’t as difficult as you think. There may be many things to look after, but it gets easier once you break down the steps you need to take.

In this case, there are three things you can do to start managing that online account better. What’s more, they’re relatively simple things to do. So, you don’t really have to worry about spending so much time figuring out your account.

Always Keep Track Of Your Balance

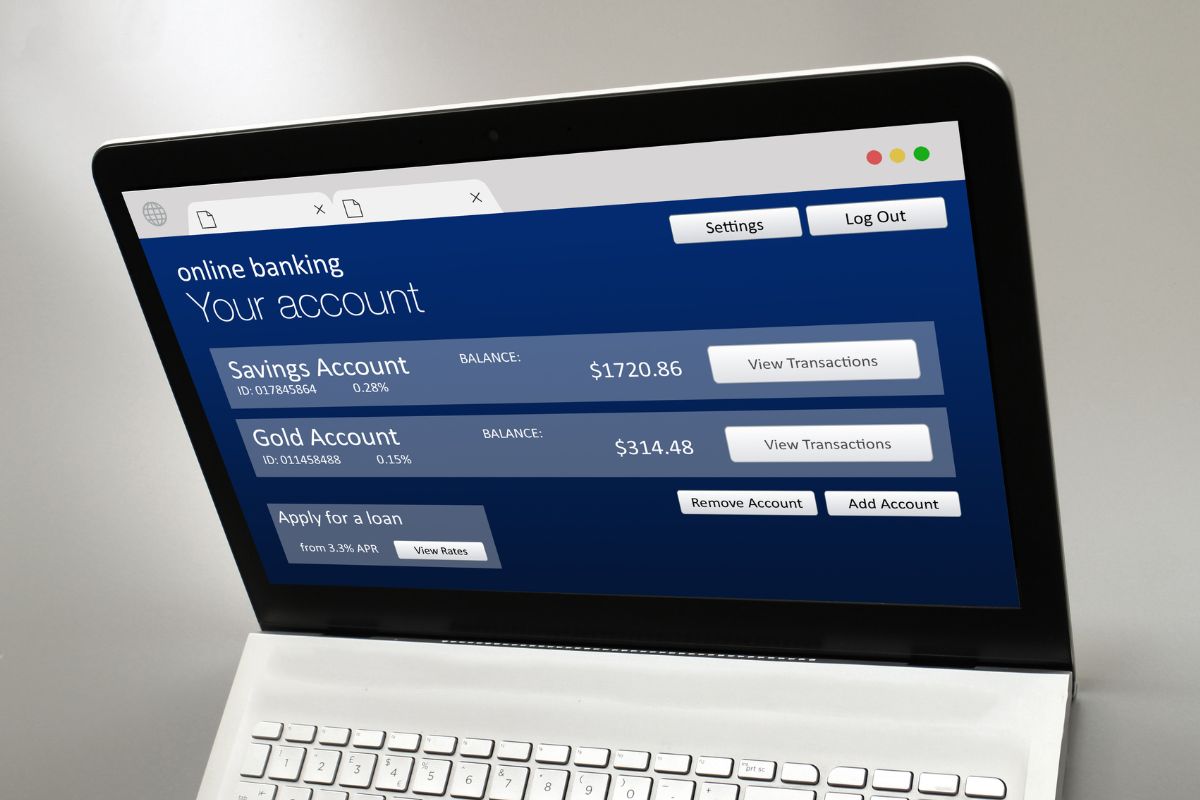

One of the most important things you can do to help manage your bank account is keep track of your balance. Whether it’s checking or savings, your accounts will have a balance. This is where your money goes.

Essentially, this is the supply you have. Your balance will tell you how much you have in the bank and how much you have left to spend.

However, while most people rest easy knowing that they have money in their account, it’s still important to keep track of how much you have. Keeping track of how much you have at least lets you know that the amount you have in your account is what it’s supposed to be, no more, no less.

This helps ensure that you’re not losing money without your knowledge. If you ignore this, you could find yourself in more trouble than you can afford.

Take Note Of Expected Transactions

In line with always keeping track of your balance, it’s also essential to take note of expected transactions that involve your bank accounts. This helps ensure you know how much money will be debited or sent to you.

By keeping track of what goes in and out of your account, you can at least cross reference this to any notice you’re given. You can then ensure you’re not being overcharged by your biller or getting an amount less than what was promised.

Aside from that, taking note of the expected transactions can also prompt you to check if you have enough money in your account. If you’re making a check payment, this is very important as this ensures that your check does not bounce.

This also ensures you don’t have a negative balance after paying for something. Because if these things happen, you may face more problems that you may not be prepared for.

Know How To Report Any Banking Concerns

Another way to help you manage your bank account would be knowing who to contact regarding any banking-related concerns. While it may never happen, there may come a time when your biller might debit twice the expected amount from your account, or your check might bounce.

In these instances, knowing how to go about these things can help make your dilemma more manageable.

Knowing how to file a concern and what channels to send them to can at least get you the help you need as soon as possible. This saves you a lot of time and trouble from feeling lost or not knowing what to do. After all, it’s better to be prepared for these things and not have them happen than to have them happen and not know what to do about them.

You Can Do It!

Managing an online bank account is more or less the same as managing a regular bank account. In fact, you can argue that an online banking account is easier to manage. This is because you can access your account conveniently from your smartphone or laptop.

So, it shouldn’t be too difficult to do. You just need to know how to go about it, so you aren’t so overwhelmed.

Thankfully, managing your account is as simple as keeping track of how much you have in your account and knowing what transactions you’ll be having.

By doing these two things, you can at least be assured that you’re responsible with your money because you know how much you have and how much you’re “spending.” Once you make a habit of these things, it’ll eventually be an effortless routine for you.

In the process, you’ll also get more familiar with how your banking platform works and how you can use it.

Online banking has made the entire process of banking more convenient for many people. So, it wouldn’t be surprising if this is something you want to engage in. Fortunately, it’s easy to pick up and learn.

All you have to remember when you get started is to do your part and be responsible enough to manage it. It’s your money, after all. So, it’s best to ensure you’re as responsible with it as possible.